Counties tax both business real estate and personal property. You should not be taxed on the same item, same building, or same parcel in both your real estate and personal property taxes.

Nevertheless, some companies do end up paying taxes twice on the same property. This double taxation is often due to reporting requirements that rely on the taxpayer as well as the separation of the two departments at the county level.

For companies with a significant amount of personal and real estate property, it can take a lot of time to analyze everything with regard to your taxes.

WHAT IS REAL PROPERTY?

The simplest definition of real property is the land and any permanently affixed structures. For example, once you build a structure on your property, it generally becomes part of the real estate itself.

HOW IS REAL PROPERTY VALUED?

Assessing the value of real property is no simple task. This is due to uncontrollable elements such as the current market price and subjective decisions about what an upgrade to the property is worth.

There are three commonly used appraisal techniques. A county should employ all three methods to create the overall assessment or “ultimate appraisal”.

THE SALES APPROACH

This method is heavily reliant on sales data from the recent sale of comparable properties. Exploring what similar properties in the same market have sold for, you can get a sense of property value.

The biggest drawback of this approach is that it can frequently be challenging to find similar properties that have been sold in the recent past and nearby.

This challenge is especially true if a property has special or unique improvements. Or if the property has had structural improvements that added significant value to the property.

What is business personal property tax?

THE COST APPROACH (A.K.A. THE REPLACEMENT COST APPROACH)

This method takes into consideration the cost associated with rebuilding the structure from scratch. It considers the current land value, construction material, construction costs, and other costs associated with the replacement of the existing structure.

Additionally, this approach takes into consideration the current condition of the property. Building a new structure from scratch would result in a brand-new facility, which would inflate the value.

SOME DEPRECIATION FACTORS INCLUDE:

- Physical Deterioration: examples include the condition of the roof, the foundation, and other structural elements, as well as plumbing, mechanical systems, and fixtures.

- Functional Obsolescence: If the building is outdated - for example, if the only way to reach the conference room is by traveling through someone’s office.

- Economic Obsolescence: This sort of degradation is typically out of the control of the property owners. External factors cause economic obsolescence. Some examples include a freeway being built next to your property, increased crime rates, construction of a landfill, etc.

The appraiser uses comparable sales to estimate land value. After that, the construction cost to replace the building is assessed, and the depreciation is subtracted from the value.

This calculation is how the final value is estimated.

THE INCOME APPROACH

The value of some properties is directly related to their ability to generate income - such as rental office buildings. For these types of properties, a county may assess value based on the income approach.

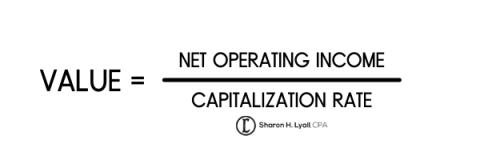

Direct capitalization is the approach used for commercial buildings. This valuation is obtained by taking the net operating income and dividing it by the capitalization rate.

- The net operating income is the gross income minus expenses. It is generally calculated by adding up all of the annual rents (the building’s gross income) and then subtracting all costs. Costs include items such as maintenance, repairs, insurance, taxes, management costs, etc.

- Capitalization rates indicate the rate of return that should be generated by a property.

If a property has a net operating income of $700,000 and a determined capitalization rate of 8%, then the property is worth $8.75 million.

WHAT IS PERSONAL PROPERTY?

Real property evaluates your land or buildings, but personal property is the assets a business needs to function. Business personal property is assessed annually based on depreciation schedules that are set forth by the government.

Business personal property is calculated differently between states and sometimes even varies by county. However, most North Carolina counties use the NC Department of Revenue Cost Index to value business personal property.

This method requires that a business list the historical cost of the asset by acquisition date. That value is then multiplied by the tax ratio to determine the tax due.

TYPES OF ASSETS INCLUDE:

Computer equipment

Office furniture and fixtures

Machinery and equipment

REAL PROPERTY AND PERSONAL PROPERTY: KEY DIFFERENCES

The differences between real property and personal property are generally straightforward.

Personal property is anything that you can move.

Real property cannot be moved and is attached to the land.

DETERMINATION: THE THREE-PART TEST

For tax purposes, counties usually employ a three-part test to determine if a fixture is considered real property.

- Attachment: If it is removed from the property, will its removal cause any damage?

- Use: How is the property used in conjunction with the real estate?

- Intent: Was the objective during installation for the structure to be permanently attached?

WHY CLASSIFICATION MATTERS

If double taxation occurs - meaning an item is taxed both as real property and personal property - it can be a monumental mistake to fix.

In North Carolina, double taxation is considered an illegal tax which can be eligible for a request for refund under NC general statute.